Stand Up India Loan Scheme 2024 Apply Online | Stand Up India Loan Scheme Online Registration | Track Stand Up India Loan Scheme Application Status| Stand Up India Loan Scheme Application Form

Stand Up India Loan Scheme is launched by our Honorable Prime Minster of India Mr. Narendra Modi. Stand Up India Loan Scheme is introduced to promote the entrepreneurship among the women’s of SC, ST. On 15th August 2015, this scheme provides the beneficiaries economically empowered.

SUI Scheme also helps in creating a job opportunities and enables to participate in the economic growth of the nation. This scheme is managed by the Department of Financial Service (DFS), Ministry of Finance, Government of India. The main objective of this scheme is to participate in the economic growth of the nation.

From this scheme near about 2.5 lakh beneficiaries through 1.5 lakh banks will be benefited. Stand UP India Scheme provides the loan between Rs.10 Lakh and Rs. 1 crore is provided to at least one Scheduled Caste (SC) or Scheduled Tribe (ST) borrower.

On 5th April Stand Up India was launched by the central government of India for Schedule caste, Schedule Tribes, Backward tribes, and women. This scheme is basically a Loan scheme that provides financial support to the lower section people of our country. This scheme encourages the entrepreneurship and employment among the SC/ST women.

In this article we are going to provide complete detail information related to the SUI Scheme like eligibility criteria for the Stand Up India scheme. Documents required for applying for SUI, objectives, log-in procedure, and how to track SUI Application status. So, interested candidates who want to apply for the Stand-up India scheme and avail the benefit of this scheme, read the complete article till the end.

Quick Highlight On Stand Up India Loan Scheme

स्टैंड अप इंडिया लोन स्कीम ऑनलाइन Apply Online 2024: Stand Up India Loan Yojana 2024 Login and Online Registration. You can also do the SUILS Application Form PDF Download and check the eligibility criteria for Stand Up India Loan Scheme. Check Payment/Amount Status, Features, Benefits and check online Application Status at official website www.standupmitra.in. रजिस्ट्रेशन फॉर्म, उद्देश्य, पात्रता, लाभ.

स्टैंड अप इंडिया लोन स्कीम Latest Update and News

The Ministry of Finance has extended the Standup India Scheme up to the year 2025. Central Government has introduced the Stand Up India Loan Scheme which facilitates the bank loan between 10 lakh and 1 crore to at least one Scheduled Caste (SC) or Scheduled Tribe (ST) borrower and at least one woman borrower per bank branch.

The central got. has extended the Stand Up India up to FY 2025. More than 1.17 lakh loans of Rs. 26,391 crore have been sanctioned to SC/ST and women borrowers under Stand Up India Scheme (SUPI) which has created 6 lakh employment for the peoples.

SUIL Scheme provides the loan between Rs. 10 lakh – Rs. 1crore to SCs/STs and women for setting and developing up a new businesses. PM Modi’s Stand-Up India scheme: Nearly 30% jump in loans sanctioned to women, SC/ST MSMEs in 2021. A good revolution happening for women, SC & ST communities under this scheme.

Stand Up India Union Budget 2024 – Official Announcement

- The extent of margin money brought by the borrower may be reduced from ‘upto 25%’ to ‘upto 15%’ of the project cost. However, the borrower will continue to contribute at least 10% of the project cost as their own contribution.

- Loans for enterprises in ‘Activities allied to agriculture’ e.g. pisciculture, beekeeping, poultry livestock, rearing, grading, sorting, aggregation agro industries, dairy, fishery, agriclinic and agribusiness centers, food & agro-processing, etc. (excluding crop loans, land improvement such as canals, irrigation, wells) and services supporting these, shall be eligible for coverage under the Scheme.

About Stand Up India Loan Scheme

The Central Government has launched a Stand Up India Loan Scheme on 5th April 2016 for promoting the Aatma Nirbhar Bharat by bringing change in the lives of SC/ST and Woman Entrepreneurs. Under this scheme, bank loans will be provided to SC, ST and women borrowers.

The bank loan range from Rs. 10 lakh to Rs. 1 crore. With the help of Stand Up India Loan Scheme at least one SC or ST borrower and at least one woman borrower per bank branch will get the loan for setting a Greenfield investment.

The main objective behind launching this scheme is to facilitate SC/ST and Woman Entrepreneurs in order to setup enterprises, providing support , obtaining loan which is required from time to time. Under Stand Up India Loan Scheme all the branches of Schedules Commercial banks will be covered directly at the branch or through SIDBI Stand Up India Portal through the lead district manager.

This scheme is encouraging the entrepreneurship and employment in our country. The financial support will be provided to set up and increase business to SC/ST and women. This will encourage the young minds to come up with different and innovative ideas and create job opportunities in the country.

At least one SC or ST borrower and at least one woman borrower per bank branch for setting up greenfield investment. The enterprise may be manufacturing, services or trading sector. In case of non-individual enterprises, 51 % of shareholding and controlling stake should be held by either SC/ST.

Stand Up India Loan Yojana, Overview

| Scheme Name | Stand Up India Loan Scheme (SUI Scheme) |

| In Hindi | स्टैंड अप इंडिया लोन स्कीम |

| Introduced by | Government Of India |

| Beneficiaries | Citizens Of India |

| Major Benefit | Provide Loan |

| Objective | To Provide Financial Support For Setting Up Enterprise |

| Scheme under | Central Government |

| State Name | All India |

| Post Category | Scheme/ Yojana/ Yojna |

| Official Website | www.standupmitra.in – Click here |

Pradhan Mantri Matsya Sampada Yojana (PMMSY)

Main Objective and Mission of SUI Scheme

Main objective behind launching the SUI scheme is to provide the financial support to the SC/ST and women in order to encourage the entrepreneurship and employment in India. Central got. will provide the financial support to SC/ST and Women to grow and set up business. This scheme also motivate the young minds to come up with different ideas and create job opportunities in India.

In Stand Up India Loan Scheme at least one SC or ST borrower and one Women borrower per bank branch for setting up the greenfield investment. The investment may be in manufacturing, trading sector or any other services. But in case of non-individual business, 51% of the controlling stake and shareholding must be held either by SC/ST or women entrepreneur.

Stand Up India scheme is generally based on the acknowledgement of challenges faced by the SC/ST and women entrepreneurs in setting or building up a businesses, obtaining loan and other support needed needed from time to time for succeeding in business.

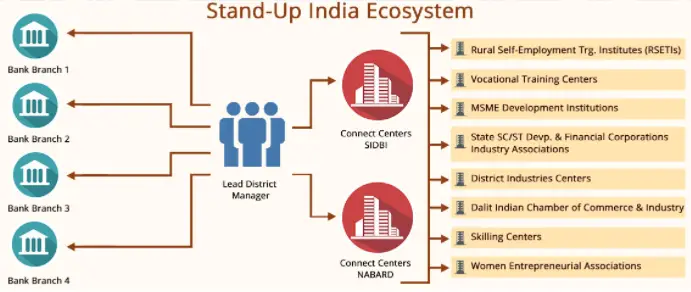

Stand Up India Scheme creates an ecosystem which facilitate and provides the supportive environment for doing and growing up a business. SUI Scheme covers all the branches of Schedule Commercial banks, will be accessed in 3 following ways:

- Directly at the branch

- Through SIDBI’s Stand up India Portal

- Or through Lead District Manager (LDM)

Stand Up India Loan Scheme Portal 2024

- If you want to avail the benefit of SUI Scheme then the beneficiary need to register through the official website.

- By using this SUI portal feedback information will be provided.

- This portal can be accessed at home, from common service center and through Bank Branch and LDM (Lead District Manager)

- Incase if any bank branch internet access is denied or restricted then the branch will guide the borrowers to an internet access point.

- With the help of this portal application forms can be obtained and gathered to provide the information.

- This SUI portal host information about the various organization which provides the handholding support to the borrowers. In which it includes training, margin money support, raw material sourcing, DPR preparation, shed/workplace identification, bill discounting, registration for taxation, e-com registration.

Features of Stand Up India Loan Yojana

- Stand Up India main aim to support the 2.5 lakh women and SC/ST entrepreneurs to set up and grow their businesses.

- 80% rebate on the patent application fee will be refunded to the entrepreneurs.

- More than 5 lakh schools around the country will be covered under the program to encourage innovation core programs.

- The scheme will provide 100% relaxation in income tax for startups for first 3 years.

- Central govt. will launch the website and application to help the interested applicants.

- Financial support amount for startups will vary between Rs. 10 lakh to Rs. 1 crore.

- Government had set a sanction target of Rs. 2.5 lakh loan in a time frame of 36 months.

- Loan application process and licensing process is to be automated for fast action and approval.

- The exit process only takes 90 days to wind up the complete process.

Types Of Borrowers Under Stand Up India Loan Scheme

Following are the types of borrowers falls under the Stand Up India Loan Scheme :

Ready Borrower :-

In case if borrower does not need any handholding support then that borrower will be considered as a ready borrower.

This type of borrower can start the process of application for loan at the selected Bank.

After application the borrower will receive the application number and the information about the borrower will be shared with the bank LDM. And relevant link office to the NABARD and SIDBI.

After that the loan application will be generated and tracked by using portal.

Trainee Borrower :–

Suppose in case if borrower needs handholding support, then that borrower will be considered as tarinee borrower.

SIDBI and NABARD will arrange the support for the trainee borrower in the form of financial training, skilling, support utility, connection, margin money mentoring etc.

Other than this LDM will also help in monitoring the procedure to work with local offices of SIDBI and NABARD which will solve problems and easy the restrictions.

After sufficient meeting, the hand holding requirement and attaining the satisfaction of LDM. And trainee borrower the application loan will be generated through the official web portal.

SUIL Scheme Important Links

| Apply Online | Registration | Login |

| ICICI Bank Apply | Click Here |

| HDFC Bank Apply | Click Here |

| BOB Bank Apply | Click Here |

| SBI Bank Apply | Click Here |

| Stand Up India Loan Scheme Official Web Portal | Official Website |

Responsibilities Of Stakeholders Under Stand Up India Loan Scheme

Bank branches

- It helps the potential borrowers for accessing the official portal.

- In case if your loan gets rejected, then the reason for rejection must be made.

- Helps in monitoring the performance of the scheme.

- Process the loan within the stipulated time frame.

- It redress the grievance at Bank Level within the 15 days.

- It helps in process all the applications which are received online or in persons.

SIDBI

- To operate and maintain the official web portal of Stand-Up India Loan Scheme

- Assisting the SLBC and DLCC in review and monitoring

- Arranging handholding’s for Trainee Borrowers

- Coordinate with LDM for easy bottlenecks

- Participating in Stand Up events organized by the NABARD

- Liaise with bank in order to follow up the potential cases by LDM/SLBC

DLCC

- Reviewing the progress periodically from time to time

- Address all the grievance at district level

- Resolving issues related to the public utility services and workspace for the potential borrowers

LDM’s

- It satisfy the borrowers requirement of hand holding to at maximum extent

- Monitoring the improvement and progress of the scheme

- Follow up with all the concerned officers

- Participating in the events which are organized by NABARD with all the stakeholders

- Provinding information to the bankers of the Poteintial borrowers

- Conducts the district level committee meetings time to time

NABARD

- It provides the training to other stakeholders

- Assist SLB and DLCC in reviews and monitoring

- Organized events when required (at least once in each quarter) among the stakeholder for sharing experience

- Arrange handholding support

- It coordinated with LDM

- Liaise with the bank to follow up on potential cases

Borrowers

- Borrowers are required to make payments in due time

- Need to submit all required documents

- If borrower is categorizes trainee borrower then they need to go through the sequence of hand holding support as applicable

- Attends all the quarterly events on experience sharing, best practice and many more.

- Setup and run the investment/ enterprise efficiently

- Borrowers need to access the portal or visit the bank branch and answer some questions

Stand Up India Loan Scheme Bank’s list

- Bank of Baroda

- Axis Bank

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- ICICI Bank

- IDBI Bank

- UCO Bank

- Union Bank of India

- State Bank of India

- Punjab National Bank

- Punjab and Sind Bank

- Jammu and Kashmir Bank ltd

- Indian Overseas Bank

- Indian Bank

PMSYM 2024 : प्रधानमंत्री श्रम योगी मानधन योजना

Margin Money And Grievance Redressal SUI Loan Scheme

- Borrower are required to invest at least 10% of the project cost as own contribution

- SUI Scheme portal provides contact details of various officers who will attend to the grievances

- 15% margin money will be envisaged

- The event will guide the entrepreneurs in making the registrations

- In case if state scheme is supporting the borrower with 20% of the support cost as subsidies, then borrower are need to contribute at least 10% of the project cost

- Different types of events will be organized at district level which involve stakeholders of the SUI Scheme in order to guide the potential entrepreneurs

- Soon there will be online procedure for submission of complaints and subsequent tracking through the portal will get started

- District level credit committee will be in charge of implementing the scheme

- Grievances of the borrower will also be addressed

- SIDBI will provide support to the organization of these events

- Feedback on disposal of complaint will be made available by the customers

Statistics of Stand Up India Loan Scheme

About Rs. 26,204 crore is sanctioned by the Banks to about 1,16,266 beneficiaries under the scheme in last 5 years.

Stand Up India Loan Scheme has benefited more than 93,094 women entrepreneurs.

| Total application | 139408 |

| Total amount | 33098.87 crore |

| Sanctioned application | 121046 |

| Sanctioned amount | 27295.18 crore |

| Hand holding agencies | 24724 |

| HHA request | 10603 |

| Lenders onboarded | 367 |

| Branches connected | 152576 |

Required Details While Providing Stand Up India Loan

Below are the required details which are needed to provide for Stand Up India Loan Scheme

- Borrower Location

- Category

- Nature of Business

- Bank Account details

- Availability of place to operate the business

- Any help needed to raise the margin money’

- Requirement of skills and training

- Amount of own investment into the project

- Any other previous experience in the business

- Assistance needed for preparing a project plan

Benefits And Features Of Stand Up India Loan Scheme

- Central Government has introduced the stand up India Loan Scheme

- Bank loan will range from Rs. 10 Lakh to Rs. 1 Crore

- Under SUI Loan Scheme composite loan of 85% of the project cost inclusive of term loan and working capital will be provided

- This loan will be repayable within a period of 7 years with the maximum moratorium period of 18 months

- This scheme provides the bank loan to the schedule caste, Schedule Tribe and women entrepreneurs

- Other than, primary security loan can be secured by the collateral security or guarantee of credit guarantee fund scheme for SUI loan as decided by the bank

- The investment can be on manufacturing, trading, services, agri ailled activity

- The rate of interest will be lowest applicable rate of bank , for that category must not exceed (base rate (MCLR) +3% tenor premium

- With the help of Stand Up India Loan Scheme at least 1 SC or ST borrower and at least 1 women borrower per bank branch will be provided a loan for setting up a greenfield investment.

- In case if the enterprise is non individual then at least 51% of the share holding and controlling stake is needed to be held by SC/ST or women entrepreneur

Document Required for Stand Up India Loan Scheme

Following are the Important Document to Apply Online:

- Aadhar card

- Caste certificate

- Application loan form

- Residence certificate

- Age proof

- Passport size photograph

- Mobile number

Eligibility Criteria Of Stand Up India Loan Scheme

- Applying candidate must be permanent resident of India

- Age of applicant must be above 18 years

- In case of non-individual enterprise 51% of the share holding and controlling stake must be held either by the SC/ST or women entrepreneur

- Applicant must be of Schedule Caste, Schedule Tribe or Women Entrepreneur

- Borrower should not be a defaulter of any Bank or financial institution

- Under Stand Up India Scheme, loan will be given for only Greenfield Enterprise

Stand Up India Loan Scheme 2024: Online Application Form

Stand Up India Loan Scheme 2024 Online Application Form PDF Download : Stand Up India Scheme main aim to promote or encourage entrepreneurship among the women and SC/ST. This scheme is organized by the Department of Financial Services (DFS), Govt. of India and Ministry of Finance.

The main purpose of the scheme is to help the banks in offering loans between Rs. 10lakh to Rs. 1 crore to at least one SC/ST applicant and 1 women entrepreneur per bank branch. This scheme covers all the branches of Schedule Commercial Banks, will be accessed in 3 following ways :

- Direct to the branch

- Through Stand-Up India Portal

- Lead District Manger (LDM)

Nature of Loan:

Composite Loan (inclusive of term loan and working capital) between Rs.10 lakh upto Rs. 100 lakh

Purpose of Loan :

For setting up a new enterprise in manufacturing, trading or service sector by SC/ST/Women entrepreneur

Size of Loan :

Composite loan of 75% of the project cost inclusive of term loan and working capital. The stipulation of the loan beaing expected to cover 75% of the project cost would not apply, if the borrower’s contribution along with convergence support from any other schemes exceeds 25% of the project cost.

Rate of Interest :

The rate of Interest would be lowest applicable rate of the bank for that category (rating category) not to exceed (base rate (MCLR) +3%+ tenor premium)

Security :

Besides primary security, the loan may be secured by collateral security or guarantee of Credit Guarantee Fund Scheme for Stand Up India Loan (CGFSIL) as decided by the banks.

Repayment :

The loan is repayable in 7 years with a maximum moratorium period of 18 months.

Working Capital :

For drawal of working capital up to Rs. 10 Lakh, the same may be sanctioned by way of overdraft. Rupay debit card to be issued for convenience of the borrower. Working capital limit is above Rs. 10 lakh to be sanctioned by way of Cash Credit Limit.

Margin (%) :

The scheme envisages 25% margin money which cab be provided in convergence with eligible Central/ Sate scheme. While such schemes can be drawn upon for availing admissible subsidies or for meeting margin money requirements. The borrower shall be required to bring in minimum of 10% of the project cost as own contribution.

PMKYM : प्रधानमंत्री कर्म योगी मानधन योजना

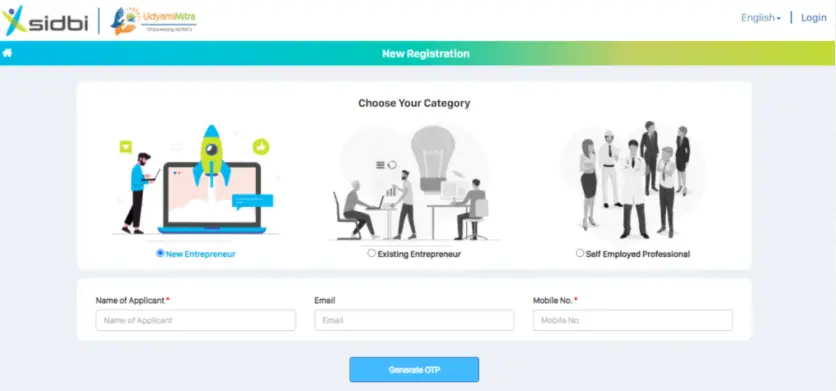

How To Apply For Loan Under Stand Up India Loan Scheme

- First of all visit the official website of Stand up India loan scheme

- Home page will appear on the screen.

- Now, click here for handholding support or apply for loan option.

- You will get redirected to the new page

- Now, n new page choose your category

- After that you need to enter your email id and contact number

- Now you need to click on the “Generate OTP“

- After that enter the OTP into the box

- Now, click on the register

- After that click on the Login

- Enter your login credentials and click on the login option

- Now, here you need to click on the Stand Up India Loan Scheme Option

- Application form will appear on your screen

- Here you need to enter all the details asked in the application form

- Next, enter all the required documents asked

- Check all the details filled is correct or not.

- After checking, click on the Submit option

- In this way you can apply under the stand up India loan scheme

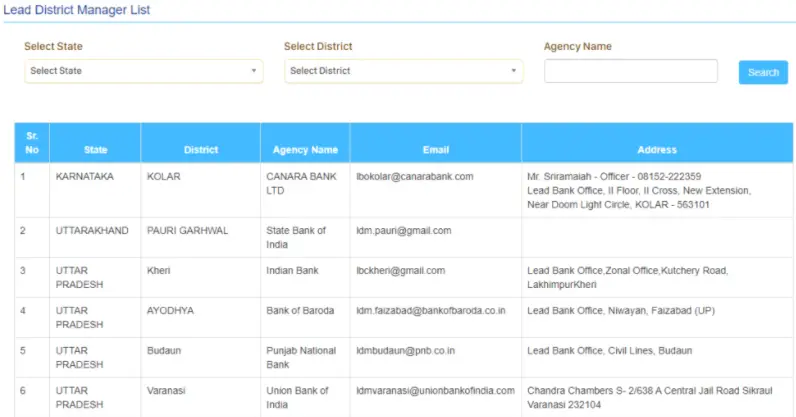

Procedure To View Details About SUIL Ldms

- First of all go to the official website of Stand up India loan scheme

- Homepage will appear on the screen

- Next, click on LDMs option.

- You will be redirected to the new page

- On this new page you need to select the state, district and agency

- Now you need to click on the search option

- Required details will appear on the screen

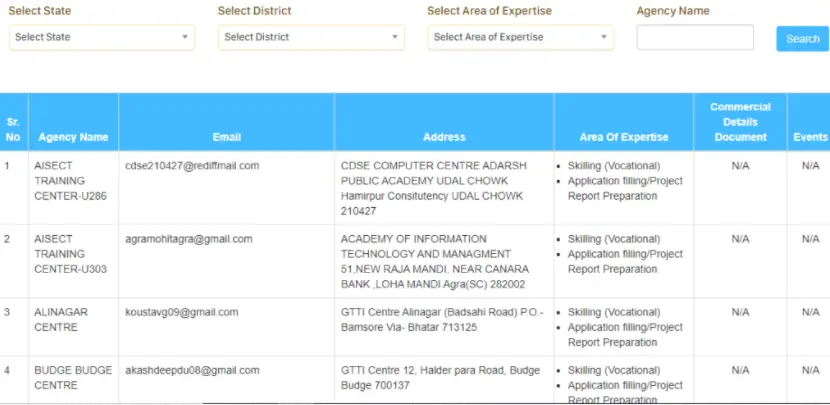

Procedure View Details Of Health Centres Across India

- Visit the official website of Stand up India loan scheme

- Homepage appears on screeen

- Now, click on health centres

- New page will gets open before you

- Here you have to select state, district, expertise and agency name

- Now, click on the search option

- Required information will appear on the screen

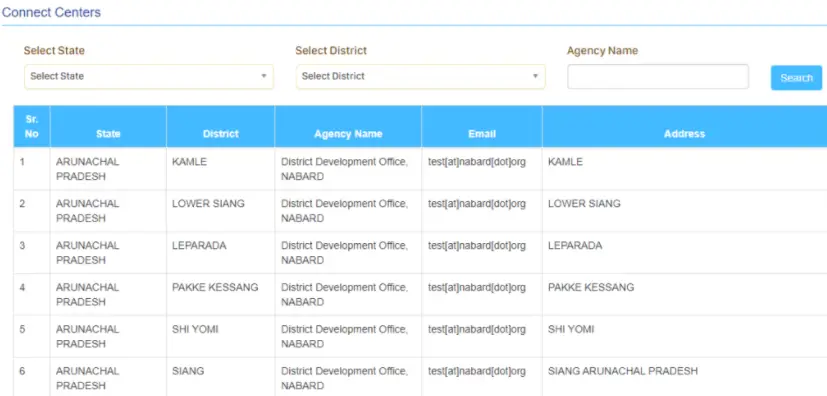

How To View Details About Connect Centres

- Visit the official website of SUI Loan scheme

- The home page will open before you

- Here, you need to click on connect centres

- New page will appear on screen

- On this new page you have select your state, district and agency name

- Now, click on the Search option

- Required information will appear on the screen

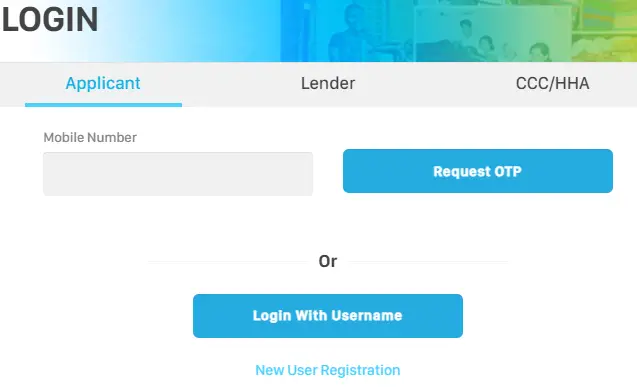

Process To Login On The Portal

- Go to the official website of Stand up India loan scheme

- Home page will open before you

- Now, click on login

- Following options will appear before you:-

- Applicant

- Other user

- You need to click on the option of your choice

- After that you have to enter your username and password

- Now you have to click on login option

- In this procedure you can login on the portal

How To Track Application Status

- Go to the official website of SUI loan scheme

- The home page will open before you

- Now, click on track application status

- New page will appear on screen

- You need to login by entering your login credentials

- Next, click on the application status

- Enter your reference number

- Now, you need to click on the Track option

- Application status will appear on your screen

For more update

| Youtube | Click Here |

| Telegram | Click Here |

| Click Here |

FAQ

The main purpose of taking loan under Stand Up India Scheme is to set up a new enterprise in manufacturing, trading or service sector by SC/ST/Women entrepreneur.

The objective of the Stand-Up India scheme is to facilitate bank loans between 10 lakh and 1 Crore to at least one Scheduled Caste (SC) or Scheduled Tribe (ST) borrower and at least one woman borrower per bank branch for setting up a greenfield enterprise.

The rate of interest would be lowest applicable rate of the bank for that category (rating category) not to exceed (base rate (MCLR) + 3%+ tenor premium).

Stand-Up India Scheme is intended to support SC/ST/Women entrepreneurs to set up a green field projects through bank branches in India while Start Up India Scheme aims to boost innovative and technology led enterprises for new/existing enterprises.

The repayment period of the composite loan is to be fixed depending upon nature of activity and useful life of assets purchased with bank loan but not to exceed 7 years with a maximum moratorium period of 18 months

Composite loan (inclusive of term loan and working capital) between 10 lakh and upto 100 lakh would be eligible